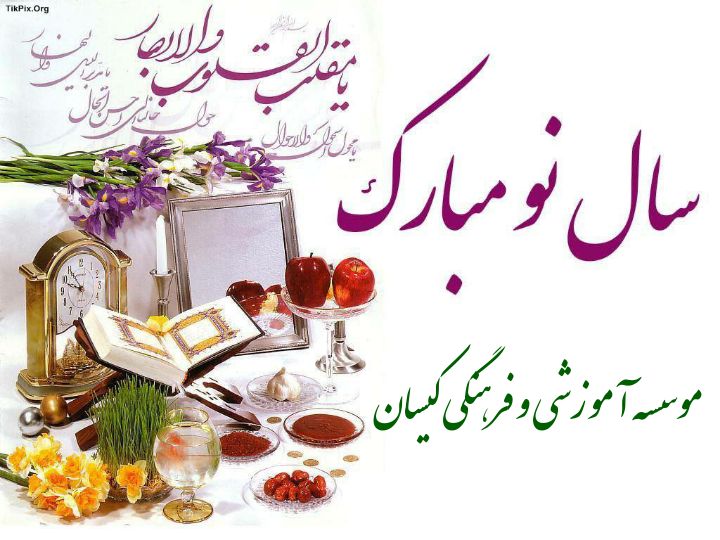

پیغام تبریک مدیرعامل کیسان به مناسبت نوروز ۱۴۰۰

پیغام تبریک نوروز

مهندس امیررضا طاهری موسس و مدیر عامل موسسه آموزشی فرهنگی کیسان

پیام تبریک نوروز این است :

دوست داشته باشید و زندگی کنید ،

زمان همیشه از آن شما نیست…

اگر چه یادمان میرود که عشق تنها دلیل زندگی ست

اما خداروشکر که نوروز هرسال این فکر را به یادمان می اورد

پس نوروزتان مبارک، که سالتان را سرشار از عشق و دوستی و شادی کند

روزگارتون همیشه سرسبز عیدتون مبارک

هوالجمیل

اثنا عرض سلام و تحیت حضور پر مهر و شیدتان، فرا رسیدن نوروز باستانی که تجلی زیبای پیدایی است را نیز

خدمت شما عمیدان و نقیبان تبریک و شادباش عرضه دارم.

با آرزوی تجربه بهترین و ناب ترین لحظات عمرتان در سال پیش رو.

سالی که رقم برگهای خاطراتش سوای مقدرات الهی بسته به نیات، تدابیر و افعال و اقدام خودمان میباشد.

سالی که دستیابی به اهداف و آماج ،میسر به مسیر انتخابی خودمان است.

بهترین سال رو امسال موسسه کیسان براتون ارزو میکنه امیدوارم سالی پر از سلامتی و شادی برای شما دانش

اموزان و دانشجویان عزیز داریم و بهترین هارو براتون ارزو میکنیم.

موسسه کیسان در سال 1400 با بهترین برنامه های تقویتی و کنکور در خدمت شماعزیزان می باشد.

سالی که مسئولیتمان چه شخصی و چه اجتماعی مزید بر گذشته هاست.

سالی که همدلی و همنگری و معاهداتمان مسبب پیروزی و غلبه بر سخت ترین شرایط هاست.

سالی که تعمیق روابط و ارتباطاتمان ممدد استیلا، اقتدار و کبریای همگانی میباشد.

نوروز ۱۴۰۰ بهانه ای است برای تجدید تعهد و تشدید تعمل برای ساختن قادمه ای روشن و پرفروغ.

مبارکبادتان این سال.

جهت کسب اطلاعات بیشتر با موسسه تماس بگیرید.

22251323

سلامتی تان پایدار، شادیتان بیکران و توفیقاتتان روز افزون و بدیع.

ارادتمند: امیررضا طاهری

دیدگاهتان را بنویسید